Cash flow financing for many companies in the SME sector involves the need to convert receivables into liquidity for the company, in fact we are talking about “bill cash”, which is the type of financing that customers are looking for here at 7 Park Avenue Financial – i.e. cash flow loans this term is synonymous with cash flow challenges that many companies constantly encounter. How, then, does the use of an AR financial company help to master this challenge?

Contents

Sooner rather than later is the need for business owners who want cash flow to meet their business needs. In many cases, certain industries require much more money for companies that participate in the industry. This could mean focusing more on capital assets or even researching new products and services.

However, what happens if you can’t get the credit financing you need from traditional banks/business-oriented credit unions, etc.? This is where an AR financial company comes in.

Your ability to quickly and efficiently set up a receivables discounting facility allows you to immediately eliminate the problem of waiting 30, 60 or even 90 days to receive customer funds for your goods and services.

In order to get the full financing of your receivables from a Canadian chart bank, there is of course an extensive loan and business application, with a lot of emphasis on historical cash flow analysis, balance sheet analysis, profit and loss account and operating figures, etc.! Invoice Cash Services eliminate 90-95% of this type of waiting and negotiation.

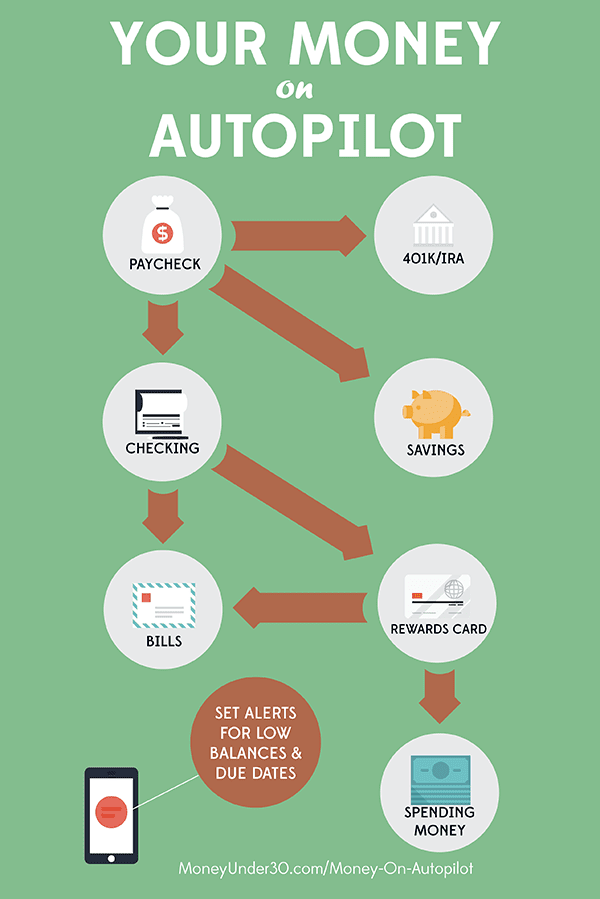

Why, then, does “factoring,” the more technical name for bill cash, work, and actually show more popularity every day when it comes to “cash advances” solutions. The answer is simple, an instant cash flow based on your sales proceeds. That will be most of the solution for what the professionals call your “working capital cycle.” This cycle is, simply put, the amount of time it takes a dollar to travel through your business and get it back on the balance sheet as cash.

If you finance through an invoice redemption – also called an invoice discounting function – you are not borrowing funds on a long-term basis. Their balance sheet does not accumulate debt; You simply liquidate current assets more efficiently.

Is there any type of facility in the “bill cash” section that works better than others? We are glad that you have asked! We constantly recommend confidential receivables financing, it is the “non-notification” part of this solution that allows you to settle and collect your own accounts, deposit your own funds and choose how much funding you need continuously. It’s a classic “pay for what you use” financing when you work with the right partner.

What is a cash flow loan?

A/R finance isn’t always the “only” way to meet cash flow needs. Other strategies could be:

- Working capital Short-term loans

- Sale leaseback strategies

- Inventory financing

- Tax credit financing (SR & ED refunds are affordable)

- Mezzanine Financing – (Unsecured Cash Flow Loans)

Longer-term solutions naturally include scenarios such as new equity.

In order to get the full financing of your receivables from a Canadian chart bank, there is of course an extensive loan and business application, with a lot of emphasis on historical cash flow analysis, balance sheet analysis, profit and loss account and operating figures, etc.! Invoice Cash Services eliminate 90-95% of this type of waiting and negotiation.

Long-term financing activities can of course include scenarios such as new equity from owners.

So let’s summarize: Your company needs additional cash flow. You either have facilities in place and they don’t work, or you finance yourself and need cash flow to pay suppliers, employees, etc. Search and talk to a trusted, credible and experienced Canadian business finance expert who can deliver bill money for your businesses.

capital one auto financing

#Business #Financing #Cash #Flow #Autopilot

- The winner of the Hottest Firefighter promises: “I’ll stay dedicated to saving lives.” - December 1, 2022

- Smiling influencer caught on camera kicking a dog apologizes for sharing the ‘cruel act.’ - December 1, 2022

- What is full coverage auto insurance in Florida? - November 14, 2022